CMS announced that short period and terminating hospitals qualifying for the HIT payment will be granted extensions on a case by case basis for cost reporting periods beginning on or after October 1, 2010 and subsequent and file on the 2552-10.

Short period and terminating hospitals not qualifying for the HIT payment will file and settle on the 2552-96 with no extensions granted for cost reporting periods beginning on or after October 1, 2010 and on or before April 30, 2011.

by Chuck Briggs

On July 27, 2011 HFS received a memorandum from CMS regarding filing deadlines for SNFs. The following is a summary of the details we received.

The 2540-10 is effective for cost reporting periods beginning on or after 12/01/2010. For any short period cost reports beginning on or after 12/01/2010 and ending 11/30/2011, providers will continue to file on the form CMS-2540-96. No extensions are proposed at this time.

by Chuck Briggs

On July 27, 2011 HFS received written confirmation from CMS that the deadlines to file on the new 2552-10 form set will be extended. The following is a summary of the details we received.

CMS issued a 30-day extension for 4/30/2011 FYE providers (Joint Signature Memo/Technical Direction Letter – 11204, 03-03-11).

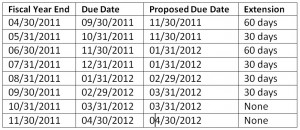

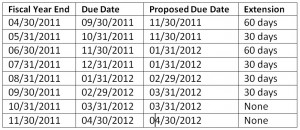

All providers with full 12 months or greater cost reporting periods which begin on or after May 1, 2010 (and end on or after April 30, 2011) must file on the 2552-10 form set, subject to the following extension schedule. (We published this same schedule in our previous 2552-10 news post, and publish it again for your convenience. There were no changes.)

2552-10 Extended Cost Report Filing Dates

Short period cost reports:

– Providers with cost report periods beginning on or after May 1, 2010, but ending prior to April 30, 2011, must file and settle on 2552-96. These cost reports are due the latter of 30 days from the date of the forthcoming TDL or 5 months following the close of the cost reporting period. This includes hospitals with hospital based end stage renal disease (ESRD) facilities and/or departments.

– Hospital based ESRDs are subject to the same extension schedule as indicated above. Hospital based ESRDs should submit their cost reports using the current 2552-10, with the existing Worksheet I series. The Hospital based ESRDs claiming bad debts may not be settled until a revised 2552-10 Worksheet I series is published incorporating the new bad debt calculation.

by Chuck Briggs

We are currently beta testing the new 2552-10 software in numerous sites across the country. Unfortunately, the new form set is still not final and therefore neither is our hospital software. CMS is still working on Transmittal 2. Transmittal 2 is needed is to fix various problems in Transmittal 1 (the current version of the 2552-10). Transmittal 2 will also implement numerous provisions of the ACA that were not included in Transmittal 1. We will work diligently to incorporate the Transmittal 2 changes into our 2552-10 software so that we may obtain CMS approval as quickly as possible. Once we obtain CMS approval we will release the 2552-10 software to all of our customers.

We realize many of you are concerned about the diminished time you will have to timely prepare and submit your hospital cost reports . We have expressed your concerns to CMS for many months now. CMS has proposed extensions for the 2552-10, but we have NOT received this as a final communication from CMS. (See table, below.) When we do, we’ll let everyone know. Until then, we can only wait on CMS.

| Fiscal Year End |

Due Date |

Proposed Due Date |

Extension |

| 4/30/2011 |

9/30/2011 |

11/30/2011 |

60 days |

| 5/31/2011 |

10/31/2011 |

11/30/2011 |

30 days |

| 6/30/2011 |

11/30/2011 |

1/31/2012 |

60 days |

| 7/30/2011 |

12/31/2011 |

1/31/2012 |

30 days |

| 8/31/2011 |

1/31/2012 |

2/29/2012 |

30 days |

| 9/30/2011 |

2/29/2012 |

3/31/2012 |

30 days |

| 10/31/2011 |

3/31/2012 |

3/31/2012 |

None |

| 11/30/2011 |

4/30/2012 |

4/30/2012 |

None |

Proposed Extensions of Cost Report Filing Due Dates

by Chuck Briggs

The new 2540-10 form set is effective for cost reporting periods beginning on or after 12/1/2010. For any short cost reporting period beginning on or after 12/1/2010 and ending prior to 11/30/2011, providers will continue to file on the form CMS 2540-96. No extension is proposed at this time.

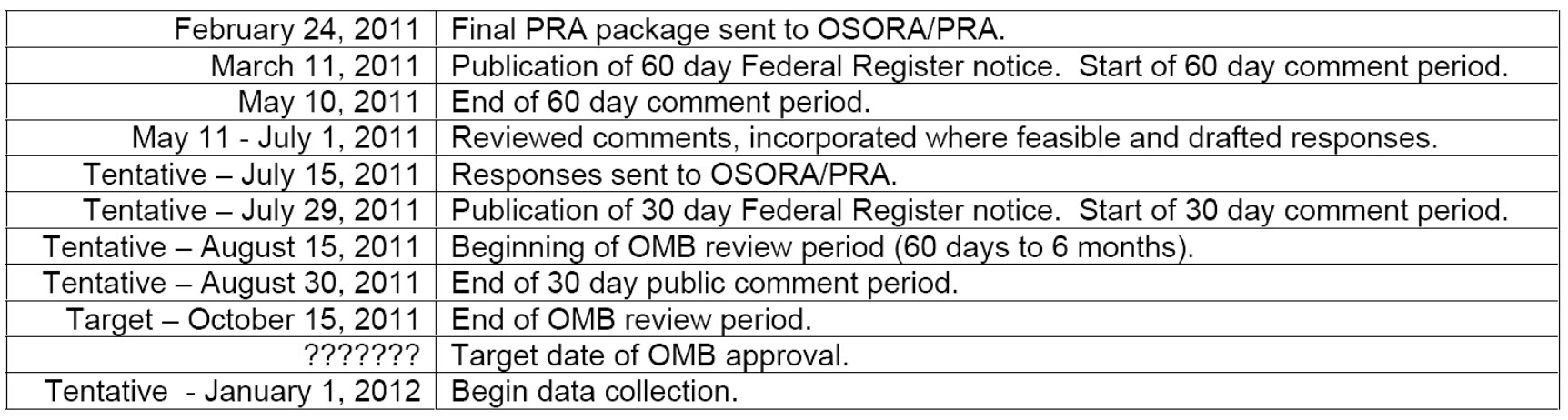

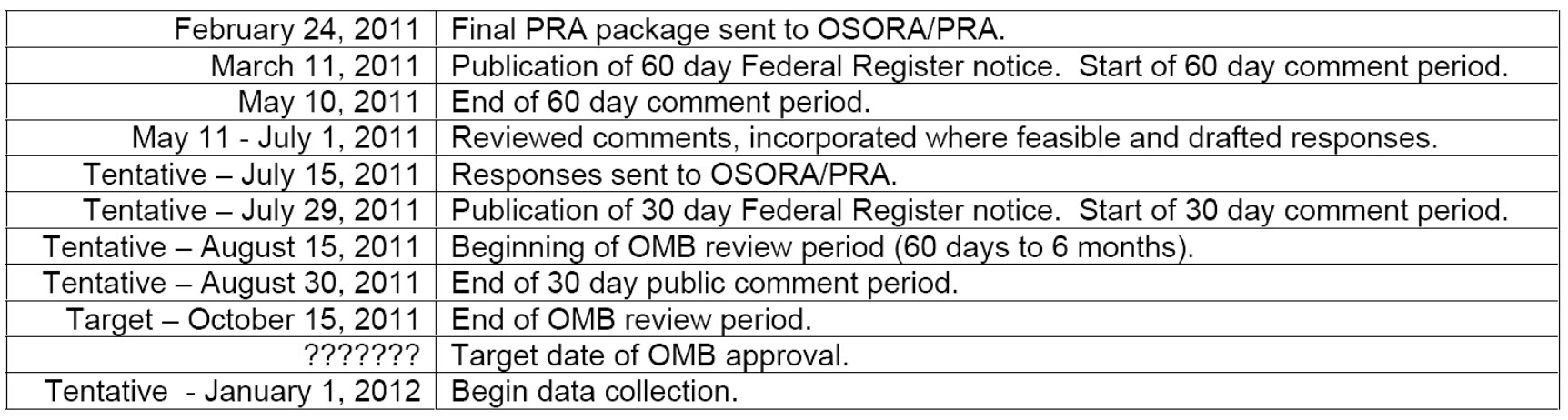

on Transmittal 2 and advised us there will be a Transmittal 3 sometime later this year. Transmittal 3 will implement applicable provisions of ACA section 6104. (Published in Federal Register, March 11, 2011, http://www.gpo.gov/fdsys/pkg/FR-2011-03-11/html/2011-5684.htm .)

The table below shows CMS proposed timeline for the Transmittal 3 changes.

by Chuck Briggs

“CMS now has a website to better service providers using IACS to access PS&R. CMS wants providers to visit the new website instead of immediately contacting the IACS help desk regarding PS&R registration or access issues. The website is located at : www.eushelpdesk.com“

I announce with pleasure that Luke DiSabato has joined Health Financial Systems support group starting 10/4/2010.

Luke is a graduate of The University of Notre Dame and has a high level of experience in Medicare.

Luke has over 20 years of experience working in the FI/MAC environment. Many of you know Luke from his previous employment and I know you will help me in welcoming him.

Luke’s contact information is:

Luke@HFSsoft.com

As part of the support team, Luke can also be reached on the support line, (888)216-6041 and e-mail, support@hfssoft.com.

Luke will be working out of OH. This will enhance our service to our East Coast users.

Thank you,

Becky Dolin

Health Financial Systems

8109 Laguna Boulevard

Elk Grove, CA 95758

888.216.6041

CMS’s Plans for the A/B Medicare Administrative Contractor Round II Procurements: Important Information for Potential Offerors Concerning –

- Consolidation of A/B MAC Jurisdictions

- Management of the A/B MAC Marketplace

- Responsibilities of the A/B MAC Medical Directors

For the full document, download the PDF here: http://www.hfssoft.com/pdfs/MAC-Round2-Special-Notice.pdf

Some users have received the Class not Registerederror message when starting the HFS software software or when opening a worksheet within the software. If you are receiving this message, follow the link below for instruction on how to resolve the problem:

HotFix HF20100309CNR: http://www.hfssoft.com/32/hotfix/pub/hf20100309cnr.html

Pete Harmon’s HFS blog has moved to a new location.

The new address is: http://peteharmon.hfssoft.com/